The Buzz on Paul B Insurance Medicare Insurance Program Melville

With Original Medicare, you still have deductibles as well as coinsurance. Medicare Benefit intends normally do not have a medical insurance deductible and also have low, set copayments. Lots of Medicare Advantage strategies additionally include out-of-pocket restrictions on what you will pay every year. Most of Medicare Benefit plans consist of coverage for dental, vision, hearing, as well as prescription medications.

All About Paul B Insurance Insurance Agent For Medicare Melville

Medicare Advantage Plans have to cover almost all of the medically essential solutions that Original Medicare covers. Nevertheless, if you remain in a Medicare Advantage Strategy, Original Medicare will still cover the expense for hospice care, some brand-new Medicare advantages, and some costs for scientific study studies. Most Medicare Advantage Plans offer protection for things that aren't covered by Initial Medicare, like vision, hearing, oral, and health care (like health club subscriptions).

These plans are provided by insurance firms, not the government government., you have to likewise qualify for Medicare Parts An and also B. Medicare Benefit strategies additionally have specific solution locations they can give protection in.

The majority of insurance strategies have a web site where you can inspect if your physicians are in-network. Maintain this number in mind while examining your different strategy choices.

The Facts About Paul B Insurance Medicare Agency Melville Revealed

Lots of Medicare Benefit prepares deal added benefits for dental care (paul b insurance Medicare Supplement Agent melville). Lots of Medicare Advantage intends offer additional advantages for hearing-related solutions. However you can buy a different Part D Medicare drug strategy. It is rare for a Medicare Benefit plan to not consist of medication coverage. You can have dual protection with Initial Medicare and also other insurance coverage, such as TRICARE, Medigap, veteran's benefits, company plans, Medicaid, and so on.

Yet you can have other dual protection with Medicaid or Special Needs Strategies (SNPs).

Nonetheless, they are certainly not an excellent suitable for everybody. We are below to clear up why these relatively too-good-to-be-true strategies have a less-than-stellar reputation. There are numerous reasons why beneficiaries might really feel Medicare Benefit plans misbehave. Some insurance holders can offer a listing of downsides, while others could be pleased with their Medicare Advantage protection.

Little Known Questions About Paul B Insurance Medicare Health Advantage Melville.

Considering that not all medical professionals approve Medicare Benefit intends, it can be testing to discover the ideal medical professional that takes your strategy, leading to a delay in care. The greatest misconception concerning Medicare Benefit prepares is that they are complimentary.

However, there is no such point as a cost-free Medicare plan. The main reason Medicare Advantage service providers can offer reduced to zero-dollar month-to-month premium plans is that Medicare pays the private firms giving the plans to take on your wellness risk. Not all Medicare Benefit strategies have a low premium price.

You can expect to pay a copay for each doctor browse through, examination, and solution you obtain. Medicare Benefit prepares commonly provide extra advantages that you won't locate on a Medicare Supplement plan. These advantages include oral, vision, and hearing treatment, prescription drug coverage, and also a lot more. Nevertheless, these added benefits can cause problems when paying for the services.

How Paul B Insurance Medicare Agent Melville can Save You Time, Stress, and Money.

The typical physician is not a fan of Medicare Benefit due to the fact that these plans put the individuals' financial danger in the hands of the doctor. The Medicare Advantage strategy carrier will pay the medical professional a set amount of cash ahead of time based medicare at 60 upon the patient's diagnosis. The only means the medical professional will make a profit is if they stay under budget.

The value of a Medicare Advantage plan relies on your location, health and wellness care requirements, budget plan, and also choices. So, for some, a Medicare Benefit strategy might be a great economic investment. If you do not routinely participate in medical professionals' appointments as well as are in wonderful wellness, you could wind up getting more out of the plan than you place in.

Merely, Medicare Benefit plans are good till they are no much longer great for you.

The Best Strategy To Use For Paul B Insurance Medicare Advantage Agent Melville

This is your only chance to register in a Medigap strategy without addressing health and wellness questions. paul b insurance insurance agent for medicare melville. If you miss this single chance to enroll, you will certainly have to address health inquiries ought to you wish to enlist in a Medicare Supplement plan in the future. This indicates the service provider might deny your application as a result of pre-existing conditions.

Are Medicare Advantage prepares excellent or negative? In find out here most cases, Medicare Benefit plans are not the very best protection alternative available. Eventually, it is essential to recognize what to anticipate from these strategies concerning rate and also protection and also become educated on which choices are budget-friendly to you and offer the protection you require.

The providers send their bid based on costs per enrollee for medical services Initial Medicare covers. Suppose the quote is greater than the benchmark amount. In that instance, the enrollee will pay the difference in the type of regular monthly costs, which is why some Benefit strategies have a zero-dollar premium and others have a month-to-month costs.

What Does Paul B Insurance Medicare Agency Melville Mean?

What is the worst Medicare Advantage strategy? The most restrictive Medicare Advantage plan in terms of insurance coverage, network, as well as dependability would certainly be an HMO strategy.

We ensure our customers are pleased and also receive a Medicare strategy that fits their budget and also health care demands. Our accredited agents thoroughly work with you to contrast the top-rated plans in your area.

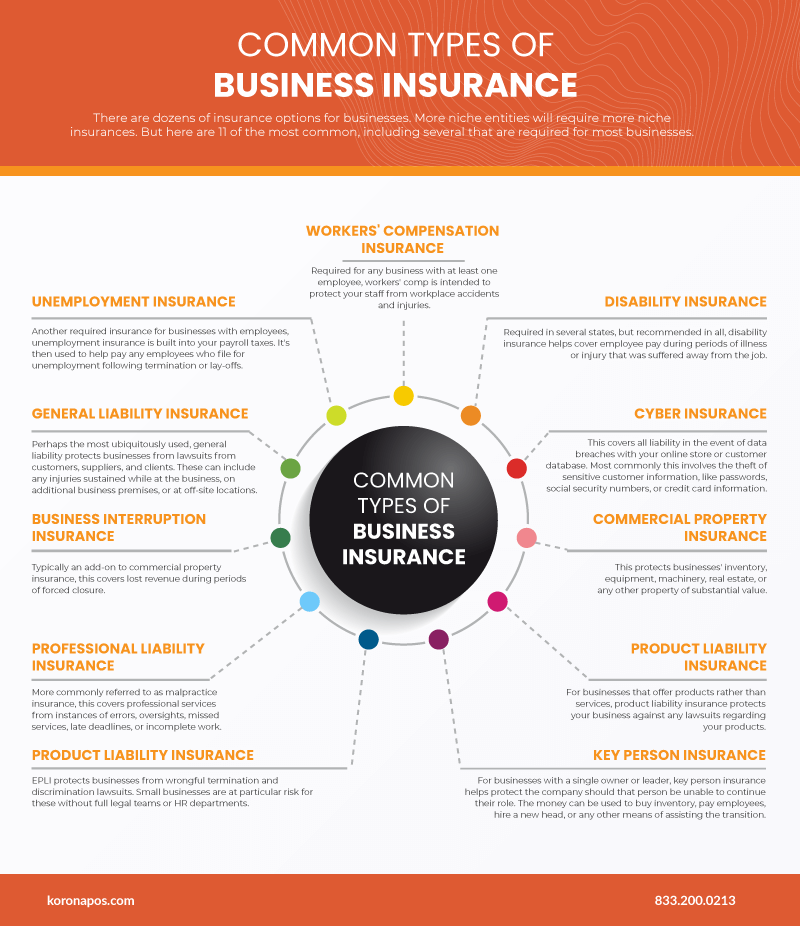

There are 2 main methods to obtain Medicare coverage: Original Medicare, A Medicare Benefit Strategy Original Medicare includes Component A (health center insurance coverage) and Component B (clinical insurance). To aid pay for things that aren't covered by Medicare, you can choose to acquire additional insurance policy known as Medigap (or Medicare Supplement Insurance Coverage).

Paul B Insurance Medicare Health Advantage Melville Fundamentals Explained

Medigap plans differ as well as one of the most thorough coverage provided was with Strategy F, which covers all copays and also deductibles. Unfortunately, as of January 1, 2020, Plan F and Strategy C, both plans that click for info covered deductibles can not be sold to new Medicare beneficiaries. If you were eligible for Medicare prior to that time but haven't yet enrolled, you still may be able to get Plan F or Plan C.

If you do not acquire it when you initially end up being eligible for itand are not covered by a drug strategy via job or a spouseyou will be charged a life time charge if you attempt to acquire it later. A Medicare Advantage Strategy is meant to be an all-in-one alternative to Original Medicare.

/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)